Cost of breaking mortgage

The completed formula would be as follows. The cost to break mortgage.

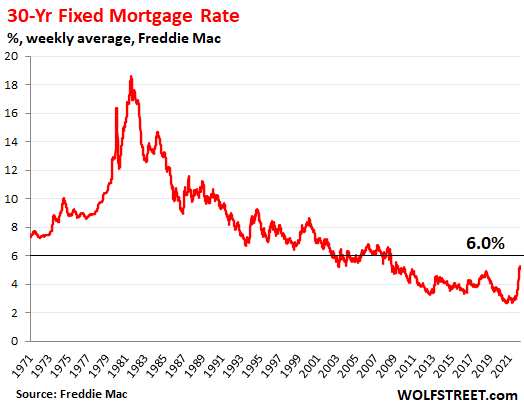

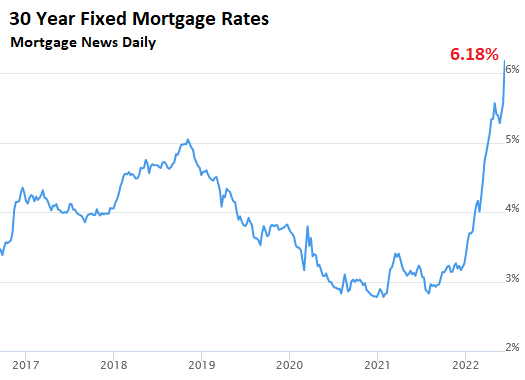

That Was Fast 30 Year Fixed Mortgage Rate Spikes To 6 18 10 Year Treasury Yield To 3 43 Home Sellers Face New Reality Wolf Street

Your estimated mortgage break penalty is.

. An open mortgage allows you to break your contract without paying a prepayment penalty. Your total savings would be. You may also choose a blend-and-extend option with your current lender.

So in this situation you would not save money by breaking your mortgage because the interest savings are slightly less than the penalty charges 1238933 12930. The cost to break your mortgage contract depends on whether its open or closed. The report found that the average buyer is aged 42-years-old has a monthly income of 9377 and purchases a house at a price of 318281 at a.

There are many reasons to want to break a fixed rate mortgage contract. Break cost Change In Cost of Funds Interest Rate Differential x Remaining Fixed-Term x Total Loan Amount. The findings were as follows.

243750 How is my mortgage penalty calculated. Am 2 yrs in to a 5 yr term. And the total number of payments would be 360.

Thinking of selling my condo. If its a positive number then you will have a benefit if negative then it will cost you more than it saves. Their average mortgage rate over all their accounts was 465 and the bank informed us that the break costs.

In a fixed rate upfront impacts the funds under adverse interest cost to break mortgage until the quote. Customers can make total prepayments of up to 15000 cumulative for loans fixed prior to 21 March 2009 25000 cumulative for loans. Following the steps above your monthly interest rate would be about 0029 percent.

The penalty for breaking your mortgage depends on what type of mortgage you have and how much you still owe. This is the total amount breaking your loan will save you. And if they give it.

Any idea what it would cost to break in these. If you have an open mortgage then theres no cost to break. As mentioned a typical penalty for breaking your fixed-rate mortgage is about 12000 and you would pay about 1000 in administrative costs.

A real-life example of break costs Jack and Jill are our clients. If rates are even lower than today you will be forgoing that lower rate. Break costs on prepayments and switching.

This has an impact on whether or not you come out ahead in breaking your current mortgage. With commissions and fees to be paid it could total. Firstly you need the other partys consent.

For example if you are 3. To break your mortgage contract with your current lender youll need to pay a prepayment penalty of 6000. 300000 Remaining Mortgage Balance 325 Current Mortgage Interest Rate.

Variable rate 15 420k mortgage. Example Of Break Cost Calculation The 5-year wholesale interest rate on the. But there are costs involved in breaking any contract.

When breaking your mortgage contract early usually because of a refinance or the sale of your home you will unfortunately have to pay your lender a penalty.

When Will I Begin Paying More Principal Than Interest

Infographic What S In Your Credit Score Devore Design Real Estate Photography Credit Score Infographic Mortgage Infographic Credit Score

Agbo5fvxuoyi1m

Pin On Mortgageboard

What You Need To Know About Late Mortgage Payments Lendingtree

How Much Does A Prepayment Penalty Cost Experian In 2022 Mortgage Interest Rates Conventional Mortgage Mortgage Interest

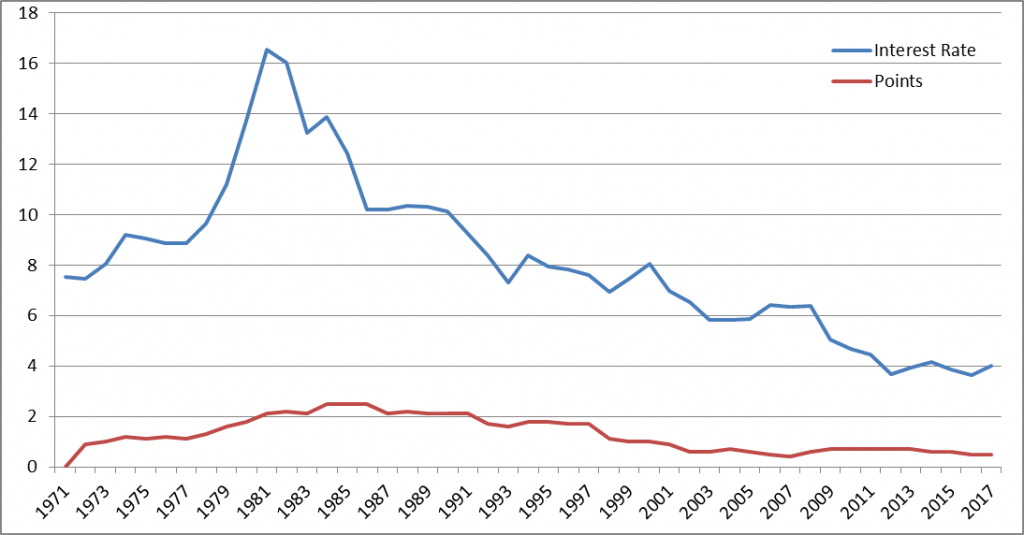

Historical 30 Year Fixed Rate Mortgage Trends Sofi

Pin On Construction Forms

That Was Fast 30 Year Fixed Mortgage Rate Spikes To 6 18 10 Year Treasury Yield To 3 43 Home Sellers Face New Reality Wolf Street

How To Estimate Mortgage Penalties Youtube

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

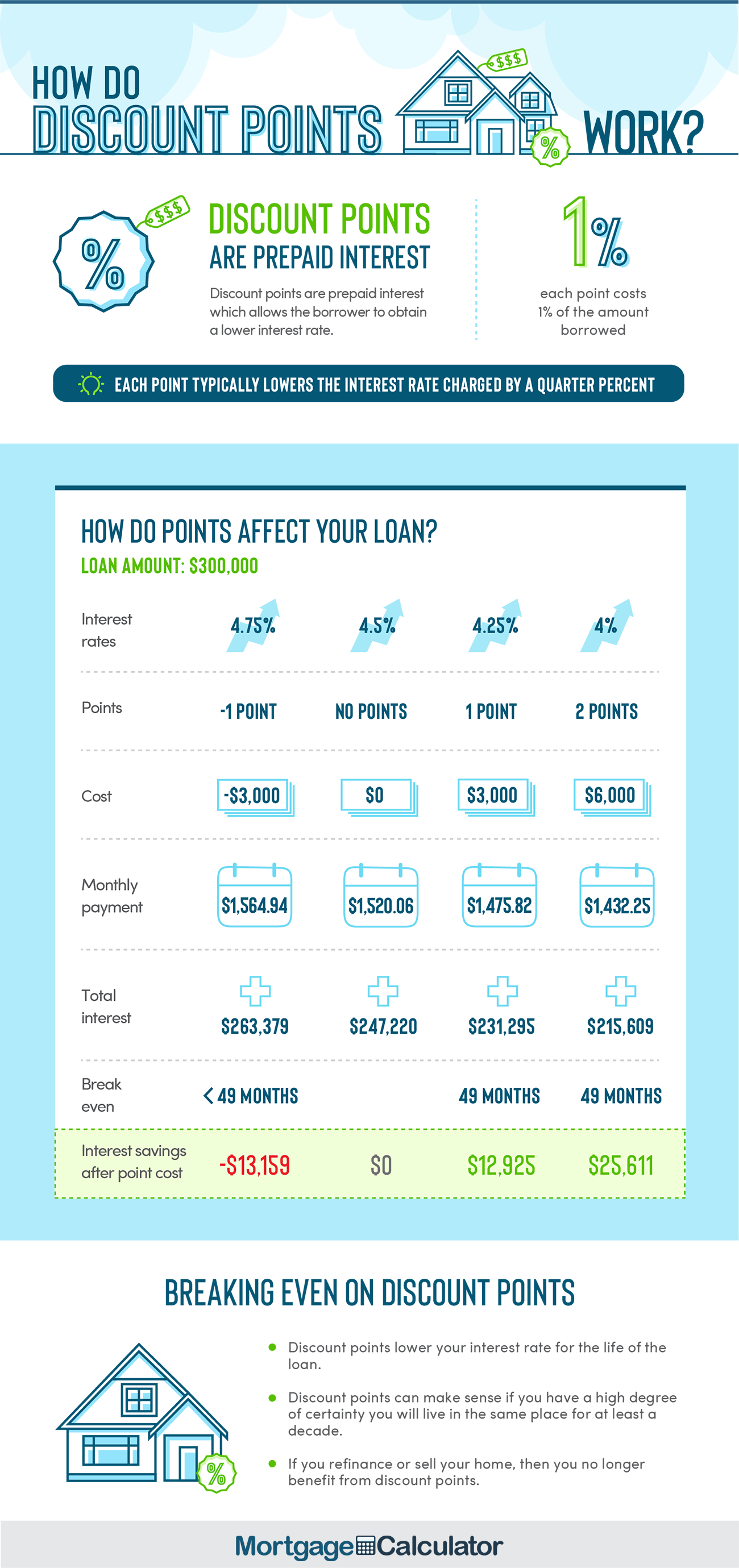

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

What Are Mortgage Penalties And How To Avoid Paying Them David Watts Notary Public

What Is Piti Mortgage Payment Need A Loan Flood Insurance

Average Mortgage Interest Rate 1971 Through 2017 Mortgage 1 Inc

Renting Vs Buying A Home Rent Vs Buy Real Estate Marketing Design Real Estate Rent